We Deliver Exponential Growth Value

Our advantage – we create the solutions right from the concept stage, so we are able to offer projects catering to the ticket size (US$ 100k to US$ 100Mn+) of the Investor.

Extensive Track Record

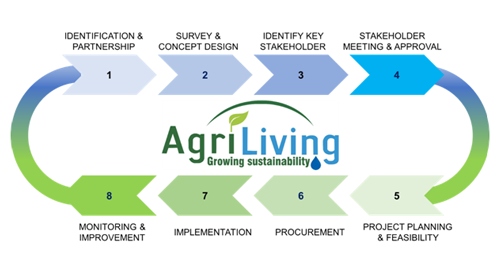

We leverage our extensive track record and practical experience to create enabling ecosystem for innovative collaboration, capacity building and multi-stakeholder engagement.

We design our projects keeping in mind the challenges faced at the micro level – community while addressing the macro level indicators like economy, trade balance, climate change, clean energy, etc.

We deliver high impact for our investors and stakeholders while achieving the financial expectations, catalyzing social empowerment and addressing ecological challenges.

We are offering “BLENDED” Social and Financial value with efforts to create profitable social enterprise.

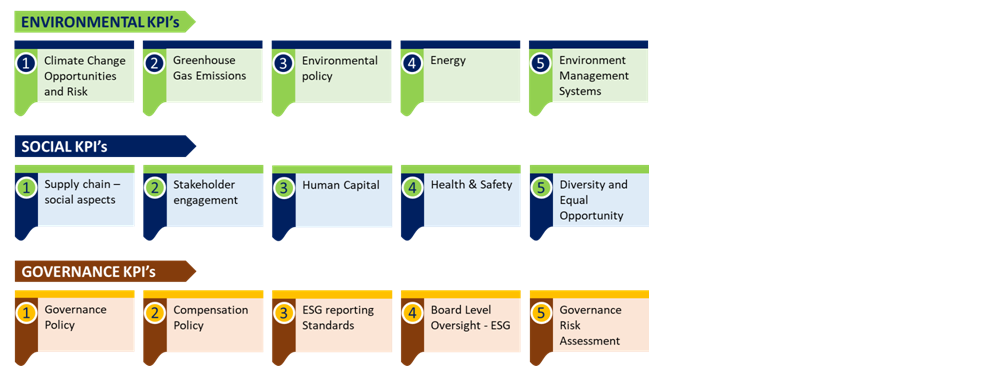

Impact Assesment & Reporting

Identify Impact Areas: Determine the primary economic, social and environmental impacts associated with the project as well as any other impacts that are material to the Investors / stakeholders;

Determine Applicable Indicators (Indicators for those sectors that are relevant to the Investors/ stakeholders to measurea critical objectives of the project.) For each of the identified impact areas, identify the applicable metrics.

Key elements for developing the metrics:

- Good leadership, governance, and strategic planning

- Clear strategic plans that identify the core mission and articulate the goals against which progress can be measured

- Robust business and funding plans to support infrastructure and research goals

- Straightforward metrics that

- Encourage strategic assessments but avoid frequent, burdensome reporting

- Advance progress in research and education, are easily understood and accepted, and promote quality

- Maintain relevance, reflecting the dynamic and rapid pace of educational and scientific progress and objectives

- Adequate human and financial resources for developing and applying useful metrics

Establish Reporting Protocols: Determine how the required data will be collected and how frequently it will be reported. Establish or adapt business processes to collect the necessary data for each selected indicator.